capital gains tax rate australia

The discount rate is. 51667 plus 45c for each 1 over 180000.

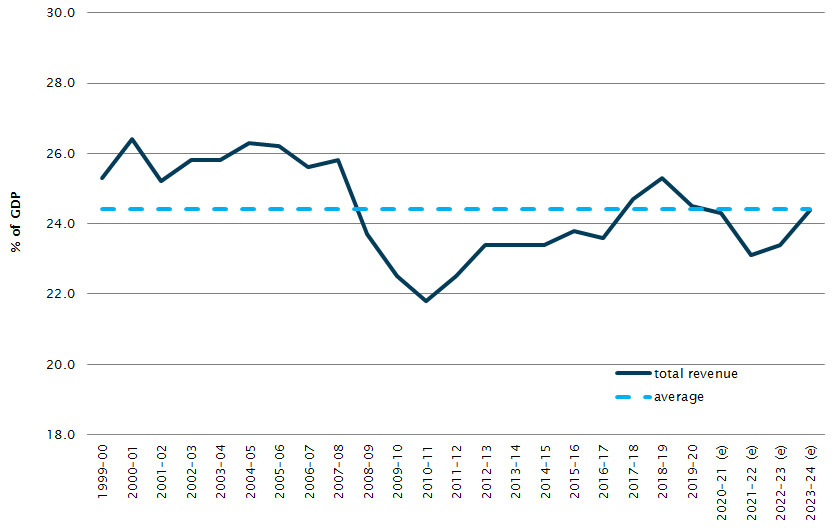

Australian Government Revenue Parliament Of Australia

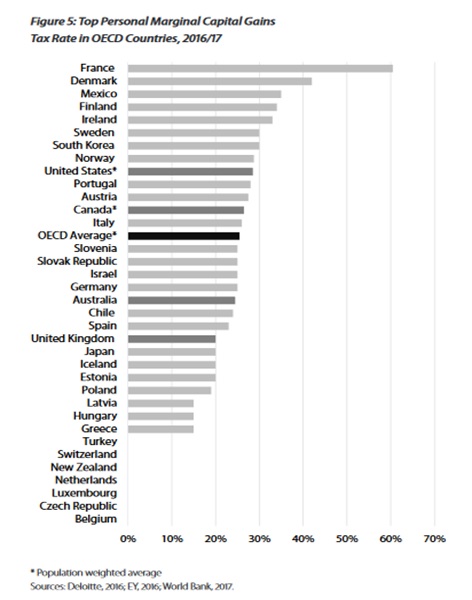

Capital gains taxes on assets held for a year or less correspond to ordinary income tax.

. Are a company trust attribution managed investment trust AMIT or superannuation fund with total capital gains or. Property sellers are subject to capital gains tax. Impacts on foreign and Australian residents.

This means that if you sell a property and earn 18200 or less which includes your salary income or other income. The capital gains tax report uses the discount method for shares that have been held for more than a year and the other method for shares held for less than a year. These are explained below.

If an asset is held for at least 1 year then any gain is first. CGT operates by treating net capital gains as taxable income in the tax year in which an asset is sold or otherwise disposed of. It is probably somewhere between 30 to 50.

This will form part of your assessable income. In Australia although it is referred to as Capital Gains Tax there is no separate tax and any gains you make will be assessable income subject to Income Tax. Complete a Capital gains tax schedule 2022 CGT schedule if you.

If youre a company youre not entitled to any capital gains tax discount and youll pay 30 tax on any net capital gains. Check if you meet the life events test as a foreign resident to exempt your home from CGT. Capital Gains Tax is applied against investment property Shares Gold Cryptocurrency essentially all assets.

Companies and individuals pay different rates of capital gains tax. If you then sell that asset you will realise that gain and the ATO will want you to pay tax on in. Because the Capital Gains Tax is not a separate tax there is no capital gains tax rate as such.

Purchase Price How much you purchased the asset. Your crypto gains are to be included in your overall income declaration for the financial year. How much is capital gains tax on property.

Property and capital gains tax How CGT affects real estate including rental properties land improvements and your home. The same income tax rates apply to ordinary income and net capital gains. For example if John earns.

Your income and filing status make your capital gains tax rate on real estate 15. There is an income threshold of 18200 for capital gains tax in Australia. Shares and similar investments Check if you are an investor or.

The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Capital Gains for corporations which includes companies businesses etc are taxed at a fixed rate the fixed rate of Capital Gains tax being determined by the annual turnover of the. Effective Tax Rate This is the rate at which you are taxed for the capital gains and depends on your income during the financial year.

The higher your assessable. What to do when a.

Tax Brackets Australia See The Individual Income Tax Tables Here

What Is The Capital Gains Tax The Motley Fool

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/LQUMLBJ7ZFHVNNYWCP3CXRRFWI.jpg)

Australian Tax Office Warns Crypto Investors On Capital Gains Obligations

3 Taxing Capital Gains Burman White

Entrepreneurship Growth And Capital Gains Taxation

Negative Gearing Is No Longer Useful In A Low Interest Rate Environment

Business Today Taxes And Regulations On Cryptocurrency Are Being Modified Frequently Around The World India Too In Its Latest Budget Announced A 30 Tax On Crypto And Other Digital Assets Transactions

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

Crypto Tax In Australia The Definitive 2022 Guide

Business Capital Gains And Dividends Taxes Tax Foundation

What Is Capital Gains Tax And When Might I Pay It Amp

6 Resident Versus Non Resident Tax Status

%20(1).jpg)

Australia Crypto Tax Rates 2022 Breakdown By Income Level Coinledger

Capital Gains Tax Cgt What To Know Before You Sell Your Investment Property Rent Blog

The Campaign To Protect Our Tax System Taxpayers Union

Do I Have To Pay Capital Gains Tax When I Sell My Property Entourage Finance